When Giants Stumble: The Market Risk of Too Few Holding Too Much

- Kristopher Persad

- Oct 20, 2025

- 3 min read

The past few days have been a stark reminder of how fragile the digital world can be. First, the fallout from the Salesforce → Salesloft disruption rippled through companies big and small across the world. Then, a major outage at Amazon Web Services (AWS) brought parts of the internet to a standstill. And of course, many still remember the great Crowdstrike outage of 2024?

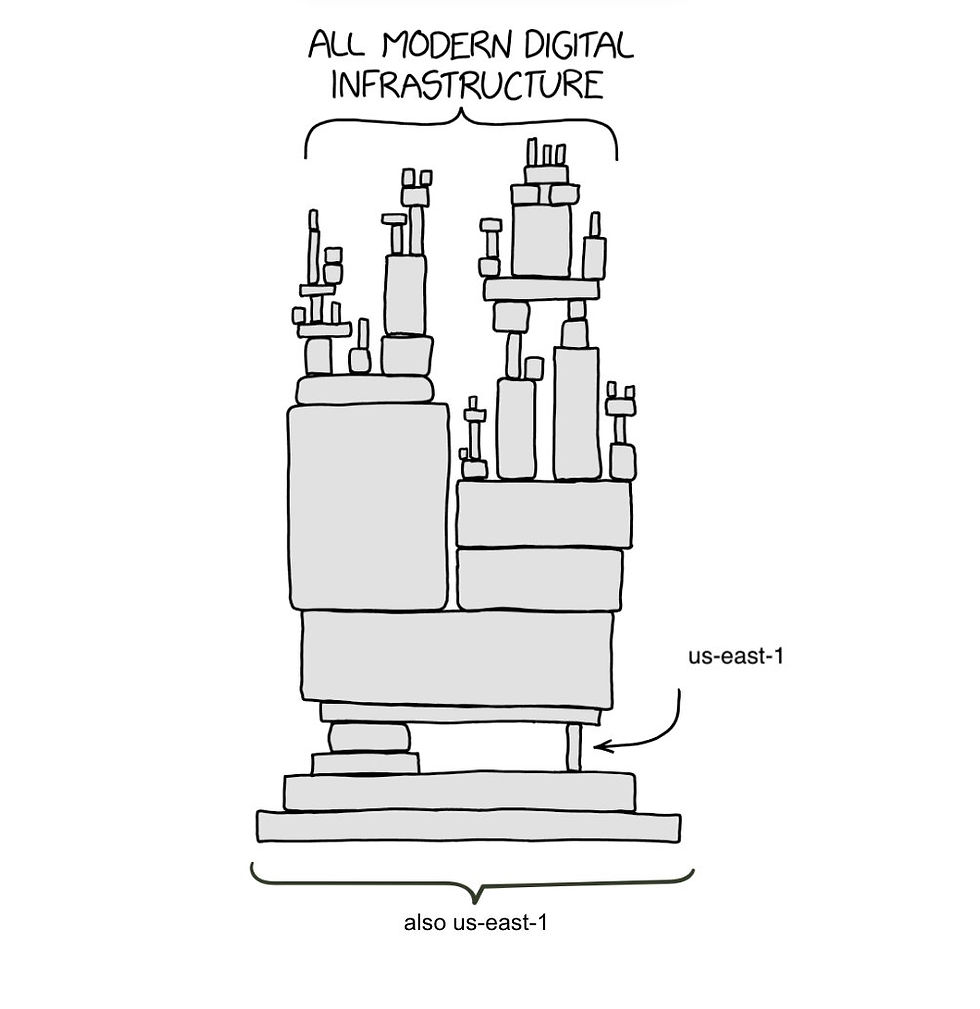

These incidents exposed a deep structural vulnerability in today’s technology landscape: a handful of companies power the digital infrastructure that entire industries depend on. When one domino falls, the rest follow in rapid succession.

~ The Axis of Vendor Scale ~

For more than a decade, the technology sector has chased scale. Hyperscaler platforms promised simplicity, speed, and cost savings by centralizing critical functions - from compute and identity to communications and customer engagement - under a shrinking number of “trusted” providers.

But scale cuts both ways. The larger and more critical a single platform becomes, the greater the blast radius when it fails. A brief outage in one region can cascade across industries, disrupting transportation networks, supply chains, healthcare systems, technology companies, and financial operations.

What was once a strategic advantage has become a systemic point of failure

~ Growth at Full Throttle ~

This risk is compounded by the relentless push to innovate and expand. The market rewards speed, first-mover advantage, and rapid feature delivery. But the trade-off is often operational fragility:

Systems grow too large and complex to fully test.

Inter-dependencies make failures difficult to identify and contain.

Redundancy strategies exist on paper but rarely hold up under real pressure.

The result is a dangerous paradox: the very platforms meant to enable resilience and innovation are becoming sources of instability and risk.

~ A Fragile Ecosystem ~

Many organizations that believed they had robust contingency plans learned otherwise this week. Multi-region deployments, fail-over designs, and “resilient architectures” buckled when the core services they relied on disappeared - even temporarily. Everything from Roblox to Ring to Wealthsimple all suffered varying degrees of impact.

These disruptions mirror patterns we’ve seen in financial systems: efficiency through consolidation eventually gives way to systemic fragility, the concentration of digital infrastructure amplifies the impact of each failure.

~ Treating Vendor Scale as a Risk Vector ~

This moment should serve as more than a cautionary tale. It’s a prompt to rethink how we assess and manage digital dependencies. Vendor scale needs to be treated like any other strategic or security risk - measurable, monitored, and mitigated.

Key Positions, and Considerations Businesses can make include:

Diversifying infrastructure rather than relying on a single hyperscaler provider, or infrastructure model.

Hold hyperscalers to testing schedules, and prove fail-over and business continuity plans with real-world scenarios, not table top exercises and simulations.

Adopting modern strategies like serverless architectures and code-only environments across multiple providers.

Encouraging regulatory frameworks that push major vendors to build resilience proportional to their influence.

~ A Predictable Pattern ~

Outages like these are no longer rare shocks: they’re predictable outcomes of a system concentrated in too few hands. The question is no longer if another disruption will happen, but when and how far it will reach.

For technology leaders, risk managers, and policymakers, the message is clear: resilience requires distribution. If the internet continues to lean on just a few pillars, even the strongest ones will eventually crack under the weight.

Comments